- Identify the key problem in the case and explaining why it is the key problem.

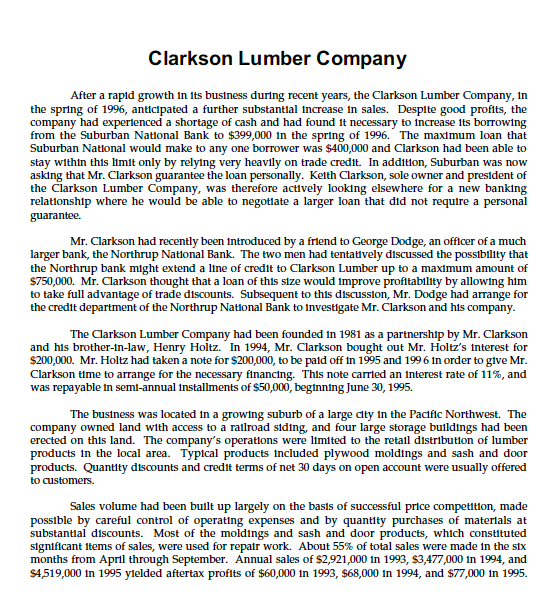

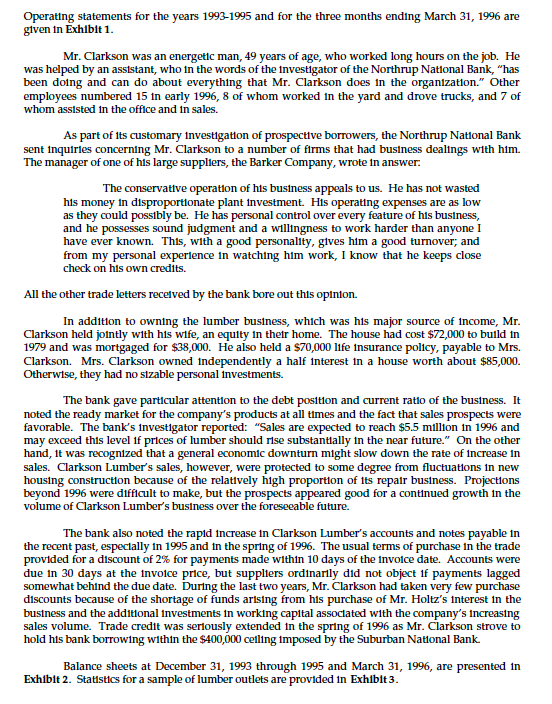

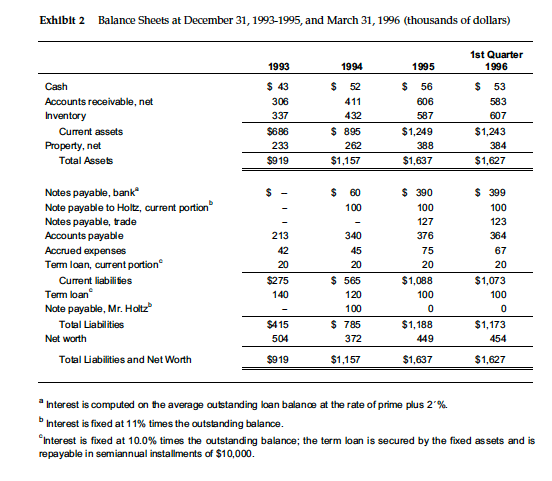

- Why has Clarkson Lumber borrowed increasing amounts despite its consistent profitability?

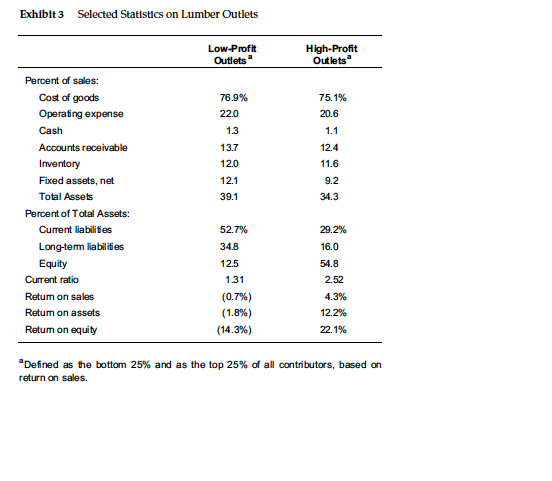

- How has Mr. Clarkson met the financing needs of the company during the period 1993 through 1995? Has the financial strength of Clarkson Lumber improved or deteriorated?

- How attractive is it to take the trade discounts?

- Do you agree with Mr. Clarkson’s estimate of the company’s loan requirements? How much will he need to finance the expected expansion in sales to $5.5 million in 1996, and to take all trade discounts?

- As Mr. Clarkson’s financial adviser, would you urge him to go ahead with, or to reconsider, his anticipated expansion and his plans for additional debt financing?

- What do you think Mr. Dodge should do and why do you think so. If you were the banker, would you approve Mr. Clarkson’s loan request, and if so, what conditions would you put on the loan?